China’s major e-tail players engage in luxury goods market war

Counterfeiting, illegal sales, unscrupulous partners: though the boon of Chinese domestic consumption appeals to Western brands, the latter have for a long time steered clear of Chinese e-tail for all of the reasons above. Something which, in the last few years, encouraged Chinese e-commerce giants to introduce a plethora of initiatives and platforms to change the opinion of Western brands, culminating recently in a comprehensive charm offensive aimed at the luxury industry.

According to the latest report by consultancy firm Bain & Co., luxury goods consumption in China leapt 15% in 2017, and was worth €20 billion. It was the highest growth rate for luxury consumption worldwide, increasing China's market share from 7% in 2016 to 8% a year later. At the same time, Chinese consumers also buy outside their borders, and as a nationality they now account for 32% of the whole market.

In the same period, online luxury goods sales worldwide took off, growing 24%. In other words, the China/e-commerce combination appears to be an extremely promising growth vector for luxury labels. Especially if the estimates of consultancy firm KPMG, according to which nearly 50% of luxury goods purchases in China will be made online by 2020, will hold true.

Dedicated websites

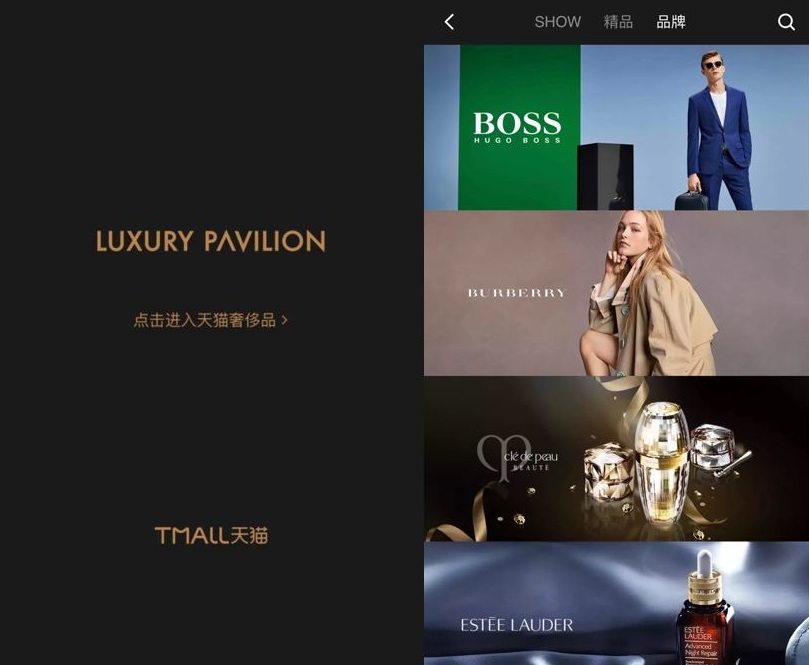

This then is the arena in which the two Chinese e-tail leaders, JD.com and Alibaba, have recently deployed in quick succession their respective online stores dedicated specifically to luxury labels. Before last summer, JD.com created Toplife, an exclusive e-store which has already attracted labels such as La Perla, Emporio Armani, Rimowa (of the LVMH group) and Trussardi. At the end of August, Alibaba responded by launching Luxury Pavilion, a section featuring high-end products within Tmall, the website created in 2008 to host leading brands.

"The reason why we launched Toplife is that we know our luxury labels," the Vice-President in charge of general affairs at JD.com, Josh Gartner, told FashionNetwork.com in a recent interview. "They prefer to be marketed through dedicated luxury websites rather than more generalist ones. So, we remain consistent with the positioning of [luxury] brands, because we want the purchasing experience to be as 'luxe' as the one in-store. Besides, all the products featured on Toplife are purchased directly from the brands themselves."

Alibaba, China's e-commerce leader, has had to adopt the same approach, embodied in its Luxury Pavilion website. "Tmall features brands, but also retailers, for example department stores, which could potentially compete with the former." Hence the creation of a separate luxury section on Tmall, which also offers a series of guarantees to luxury labels: "Consumers know that on Luxury Pavilion they are buying directly from the brands, so there is no room for fakes,", said Sébastien Badault, General Manager France of Alibaba, who joined the Chinese e-commerce giant two years ago, after being in charge of international key accounts at Google.

The alliance game

It was from France that Alibaba first reached out to luxury labels, according to Badault: "Even though the Chinese are the world's top luxury consumers, there was nothing of the sort on Tmall. Our CEO Daniel Zhang liked the idea of reaching out towards the luxury industry. Besides, it was the right time for it, since the pricing problems connected with taxation were being ironed out, as labels were lowering their prices."

"This is clearly a golden opportunity, and the time is right," said Sean Wang, Vice-President of Netease Kaola, the Chinese leader in cross-border e-commerce, who recently went on an international tour to win over luxury brands. "It is now abundantly clear that China is the core of world consumption. The middle class [in China] consists of over 300 million people, and Western brands are in pole position for responding to new [customer] expectations."

According to Wang, the luxury industry is also benefiting from the Chinese government's change in mentality. "Previously, the government urged the brands who wanted to sell on its domestic market to source locally. Now, China understands that each country has its own strengths, and that fine products must be imported from where they are manufactured."

"Until now, [e-tail] sites were mostly generalist, ranging from the low to the high end of the market spectrum, and fashion brands were very cautious in how they featured on them. JD.com and Alibaba went on the offensive with their new platforms dedicated [to luxury], to reassure labels against the risks of counterfeiting. Fashion labels will very likely test these sites, since they can't afford to overlook the huge traffic they generate. We're talking hundreds of millions of visitors," said Claudia D’Arpizio, a partner at Bain & Company.

"China is, in absolute terms, the market with the highest potential for e-commerce. In the next two years, we are forecasting extremely strong growth in luxury sales on the web, notably via mobile and WeChat," added D'Arpizio. WeChat, one of the most popular social media in China with over 870 million active daily users, has been very busy in the last year, introducing a host of special initiatives in partnership with major labels.

Saint Laurent, like many of its competitors, is well aware of the huge rewards to be reaped on this market. In early August, the Kering group's luxury label announced the launch of an e-tail site in China, via British luxury goods marketplace Farfetch. Saint Laurent was actually the first label to benefit from the newly created alliance between Farfetch and JD.com, after the latter shelled out €355 million last June to become the majority shareholder of the British luxury website.

For the occasion, the founder and co-CEO of Farfetch, José Neves, said that "in China, e-commerce is the only way to achieve full market penetration. However, until now, doing business online in China on a large scale was incredibly complex for luxury brands. This is why we set up a peerless website there." How does this work? The collections available at Saint Laurent's shops in China are integrated with the label's e-store, and thanks to the technology and logistics support of Saint Laurent’s partner, combined with that of JD.com, the label is one of the few brands with guaranteed 90-minute delivery in the country, while limiting the risk of fakes.

"An increasing number of brands are trusting pure players. In the luxury sector, this makes a difference. It all hinges on respecting the values which designers breathe into their creations. As you well know, some e-commerce players don’t respect these values," said Josh Gartner of JD.com.

The logistics capabilities of China's number two e-commerce player, with nearly 350 distribution hubs and warehouses, combined with Farfetch's sourcing expertise, will help JD.com improve its image and raise its standards, as well as the quality of its performance. The only thing left to do then is to reassure fashion labels, explaining to them that e-commerce involves fewer counterfeiting risks, thanks to the greater ease of setting up a monitoring and tracing system on the web as opposed to doing so in physical stores.

To be more convincing in dealing with major European luxury names, JD.com is about to inaugurate its European headquarters in Paris, a year after Alibaba established its own Parisian office. And JD.com’s decision to set up shop in uber-chic avenue George V signals the intention to keep a close eye on the competition, located next door on avenue Montaigne.

Others chose Milan to woo Italian fashion labels, as did Mei.com, the Chinese luxury goods website co-founded in 2009 by French businessman Thibault Villet, who still leads the company after Alibaba acquired it in 2015. Last September, Mei.com staged a special event for the opening of the Milan Fashion Week, to meet the Italian media and local entrepreneurs.

"The Chinese middle class is made up of 360 million people, a number that will double by 2020, and they adore Italian luxury products. But the country has 260 cities with more than one million inhabitants. Fashion labels have no other choice than resorting to e-commerce if they want to tap this consumer potential outside of mega-cities like Shanghai, Beijing, Guangzhou and Shenzhen, where they already have a retail presence," said Mattia Mor, Executive Director Europe of Mei.com.

"China has huge potential, but the online market is dominated by the big players. Brands that wish to open an e-shop in China must do so via the websites of giants like Tmall, or Alibaba's Luxury Pavilion. Consumers cannot keep an endless list of apps on their mobile phones. They prefer dealing with one platform only. Brands have understood this, and what we are seeing is actually a change in approach," added Mor.

"Luxury labels didn't expect to have to go through these dominant players in China," said Stéphane Rouqette, Managing Director of Azoya France, specialised in supporting Western brands in their approach to Chinese e-tail. "Not everyone is willing to sell on Alibaba, JD.com or Kaola. What’s important is to position the brand appropriately on the market. If your company isn't well-known [in China], a cross-border strategy surely isn't the most fitting: what's needed is a genuine brand strategy," added Rouquette.

Ultimately, the profitability of going through local marketplaces remains an issue for all labels. And some big names, despite the risk of setbacks, prefer to invest in doing business directly. Notably Louis Vuitton, which last summer unveiled its new, dedicated website and a bespoke strategy for the Chinese market.

Copyright © 2024 FashionNetwork.com All rights reserved.